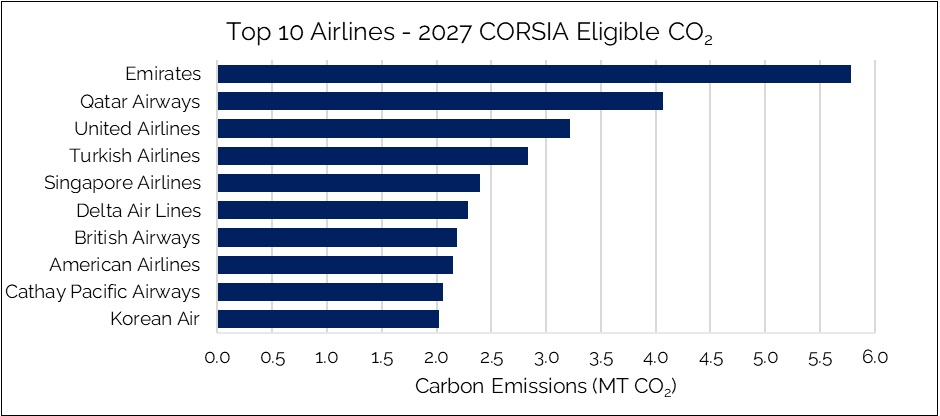

Through its NetZero assessment platform, IBA calculates the top 10 international carriers will collectively be responsible for offsetting 29 million tonnes of emissions in 2027 alone, or almost 37% of the volume that must be offset, potentially resulting in huge costs for some operators.

Referencing research by financial data analyst MSCI, which estimates eligible offset prices could increase $25-$60 per tonne by the late 2020s, IBA calculates large long-haul airlines such as Emirates, whose entire network is comprised of international routes, could face CORSIA-linked compliance costs of up to $346 million in 2027. This is equivalent to 3.5% of the Gulf carrier’s projected fuel budget or not much less than the list price of a new Airbus A350-1000.

Source: IBA

Since January 2019, all aircraft operators whose flights emit more than 10,000 tonnes of CO2 per year have been required to report annual emission levels to their national regulator, which then refers those submissions to an independent third-party organisation to verify that data is accurate. Governments and ICAO then work together to advise airlines of the number of offset credits they will require.

These obligations can be met by purchasing CORSIA Eligible Emissions Units (EEUs), which are credits recognising investments in specifically approved carbon reduction projects, or purchases of CORSIA Eligible Fuels, including SAF developed with approved feedstocks.

CORSIA is being implemented in three stages. The first, a Pilot Phase applied between 2021 and 2023, was followed by Phase 1 from 2024 to 2026, with both voluntary for many participating states. ICAO reports 129 out of its 193 member states are currently participating in the programme.

Phase 2, which commences in 2027 and runs through to 2035, is mandatory (although States cannot be forced to join the scheme) for most international flights, with four exceptions – Least Developed Countries (LDCs), Small Island Developing States (SIDS), Landlocked Developing Countries (LLDCs) and smaller aviation markets.

“Global demand will ultimately depend on the level of airline participation,” says IBA. “However, current estimates, based on Phase 1 volunteering states and mandatory compliance, indicate that 79.25 million tonnes of CO2 emissions will be eligible for offsetting under CORSIA in 2027.”

This milestone, adds IBA, is expected to bring into the CORSIA scheme countries not currently participating, including China and India, the world’s second and third largest air transport markets, and two of the fastest-growing, a development expected to significantly increase demand for ICAO-approved carbon offsets.

However, the company says there are currently insufficient approved offsets available for airlines to meet their obligations under CORSIA Phase 2.

“While demand rises sharply, supply remains constrained,” says IBA. “Only credits from ICAO-approved programmes with valid Letters of Authorisation (LoAs) and host-country adjustments qualify. As of mid-2025, just (approximately) 1,500 of 4,000-plus eligible projects are in jurisdictions prepared to issue LoAs.”

IBA estimates 15.8 million CORSIA-authorised credits have been issued so far, associated with an initiative undertaken in Guyana under the Reducing Emissions from Deforestation and Forest Degradation (REDD+) programme, a UN-backed category which enables credits to be generated by protecting and sustainably managing forests.

“Even with optimistic scaling of new mechanisms like jurisdictional REDD+ (JREDD+) and the Paris Agreement Crediting Mechanism (PACM),” claims IBA, “total supply before 2027 is unlikely to exceed 136 million credits, which is barely enough to cover Phase 1 demand.”

Among the countries participating in CORSIA, IBA says Asia-Pacific nations have the highest obligations for offsetting. With China and India expected to comply from 2027 – which is not yet certain – international flights departing APAC countries will face carbon offset requirements of around 27 million tonnes, or 34% of the projected global total.

“Without action to unblock more supply,” says IBA, “the CORSIA Phase 2 market may drive up offset prices and/or create serious compliance challenges for airlines and regulators.

“Tightening eligibility standards underscores the need for urgent coordination among ICAO, governments and project developers to ensure that credible offset supply can scale in line with CORSIA’s ambitious demand.

“Otherwise, the programme risks seeing its environmental goals undermined by a severe shortage of credits and an uneven participation.”

IBA’s CORSIA estimates coincide with its analysis of global aviation trends in the first half of this year, in which global available seat kilometres increased by 4.6% year-on-year, and 9.9% compared to 2019, before the pandemic.

“International traffic was the primary driver of growth, with ASKs up 6% year-on-year in H1 2025, while domestic capacity saw a more modest increase of 2%. Compared to H1 2019, domestic capacity is 16% higher, with international capacity now ahead by 7%, marking a steady return of long-haul connectivity and cross-border demand.”

Top image: ICAO

Tony Harrington

Correspondent

More News & Features

News Roundup January 2026

Lessons learned from the collapse of Fulcrum BioEnergy

Early data shows uncertainty that UK SAF mandate can be met in its first year

SkyTeam announces airline finalists of its competition to drive action on sustainability

News Roundup December 2025

Swiss advanced SAF technology startups Metafuels and Synhelion reach project milestones