An updated report by European aviation and aerospace industry associations estimates decarbonising the aviation sector in line with a Net Zero by 2050 target will require total expenditures of €2.4 trillion ($2.5 trillion), an increase of €510 billion (27%) from previous estimates. This will largely be driven by higher than previously anticipated market prices for sustainable aviation fuel. Unveiling its second Destination 2050 roadmap report, four years on from the first, European industry leaders said progress towards Net Zero had been promising but urgent action was needed by policymakers to incentivise and drive investment and funding in developing new technologies and, in particular, SAF production and reducing the price premium for alternative aviation fuels. The report says SAF must make up 80% of the fuel mix by 2050, 10% higher than required under the ReFuelEU Aviation regulation.

The Destination 2050 alliance is made up of five industry associations representing airlines, airports, air navigation services and aerospace manufacturers: Airlines for Europe (A4E), European Regions Airline Association (ERA), Airports Council International (ACI) Europe, CANSO Europe and the Aerospace, Security and Defence (ASD) Industries Association of Europe. As with the first roadmap in 2021, the updated Destination 2050 roadmap report was prepared by Dutch consultants Royal Netherlands Aerospace Centre (NLR) and SEO Amsterdam Economics.

“The report tells us we have made progress and that the net zero target is still achievable, and our commitment remains firm. But it also tells us that the challenges are far higher than what we had expected at the beginning,” Armando Brunini, CEO of SEA Milan Airports and President of ACI Europe, told the media at the launch of the report in Brussels.

“It is clear we are not able to do this alone. We need policymakers to support us and this must happen now as a matter of urgency. There is a window of opportunity, which if missed, we will not make it to Net Zero.”

The 2021 roadmap forecast that an anticipated 2% compound annual growth in passenger demand over the period under a business-as-usual scenario would fall to 1.6% as decarbonisation costs would have to be passed on to passengers. With the extra €510 billion costs now estimated, that growth is forecast to fall to 1.4%.

The anticipated contribution of hydrogen aircraft to 2050 decarbonisation efforts has been reduced, with SAF by far the single biggest contributor. That the industry foresees SAF making up 80% of the total fuel mix by 2050, up from 70%, is due to optimism over the voluntary commitments from airlines in Europe to buy SAF and the industry’s actions in working to increase today’s 50% maximum SAF blends to 100%.

As there was no market in place at the time of the first report, future prices for SAF were modelled on the basis that prices would come down as uptake increased, but four years on, this is likely not to be the case.

“I can confirm on behalf of airlines that SAF prices are in no way going down,” said Ourania Georgoutsakou, Managing Director of A4E. “That’s why we need to act now in Europe and accelerate the availability of affordable SAF.

“Firstly, we need to incentivise investment and support those companies financing this investment, which also includes those airlines that are putting their money in and sharing the risk. Secondly, we need to bridge the cost gap.”

The industry partners are calling for a high-level dialogue with the European Commission and EU member states to align efforts, foster collaboration and accelerate policy development. They propose the setting up of a jointly agreed EU Aviation Industrial Strategy and a Sustainable Transport Investment Plan (STIP) and linking them with the EU’s Clean Industrial Deal, which is due to be unveiled by the Commission’s President shortly.

To help address the price gap for SAF and reduce its cost for airlines, the industry is calling for a significant increase in the currently available number of free EU ETS SAF allowances and extend the scheme’s original timeline beyond 2030. The EU has so far allocated 20 million free allowances, valued at €1.6 billion based on an allowance price of €80, to the aviation sector for the period 2024-2030. These allowances aim to cover in part or in whole the price gap between conventional kerosene and eligible alternative aviation fuels uplifted from January 2024.

To de-risk investment in SAF production, it calls for direct EU funding for refinery creation or the establishment of an EU Contracts for Difference mechanism funded through a portion of EU ETS revenues for those airlines that contribute to the scheme, and supported through the STIP. The industry also calls for the inclusion of electricity requirements for SAF and hydrogen production in the EU’s energy supply plans and the implementation of an EU book-and-claim system to support the deployment of SAF until it becomes available at all required locations.

The report recommends a range of other policy measures aimed at accelerating innovation, supporting research and fostering funding for aviation decarbonisation efforts in the EU. It also calls for global cooperation to enable future technologies and align international standards to those of the EU at ICAO level, including the strengthening and extension post-2035 of the CORSIA scheme in line with ICAO’s 2050 Long-Term Aspirational Goal, “and establishing an ambitious global SAF policy to tackle non-CO2 emissions through international approaches.”

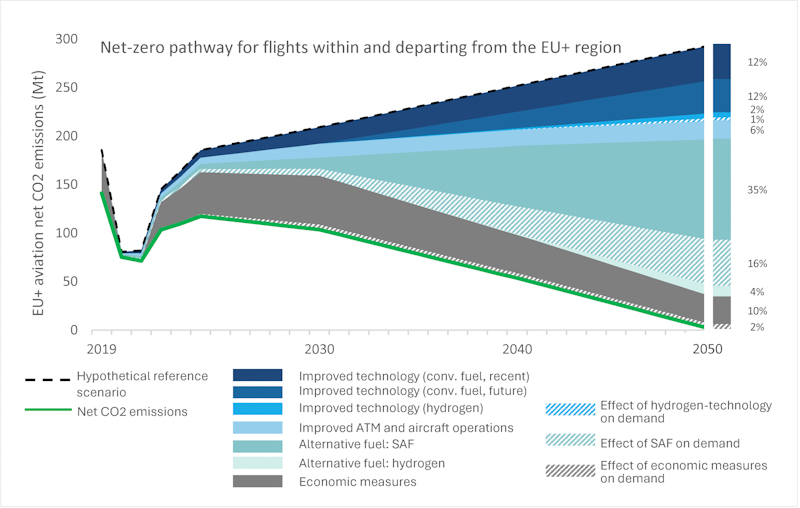

The Destination 2050 roadmap relies on market-based, or economic, measures (MBMs) to bridge the gap until other emission reduction pillars, such as alternative fuels, have sufficient impact. MBMs, such as the EU ETS and CORSIA, will make up a 12% share of total emission reductions by 2050, or roughly 35 Mt CO2. The report says MBMs should align with net-zero goals and incorporate high-quality carbon removals.

Additional decarbonisation pillars include aircraft operational and air traffic management (ATM) efficiency improvements that can be actioned over the short and medium term. The roadmap estimates the direct improvement potential from such measures increases from 14 Mt CO2 in 2030 to 19 Mt CO2 in 2050, which would enable a 7.8% improvement in fuel burn on average per flight in 2030 and 11.6% improvement in 2050.

Whereas alternative fuels, including SAF and hydrogen, will be responsible for a 56% share of overall emission reductions by 2050, or around 163 Mt CO2, improvements in aircraft and engine technology will result in emission reductions of 79 Mt CO2, a 27% share of the total.

The report says implementing the decarbonisation measures at the scale and speed outlined in the roadmap is compatible with a 1.7 degree C pathway (66% likelihood). “However, additional measures would be needed to be compatible with stricter carbon budgets associated with a 1.5 degree C pathway (50% likelihood),” it acknowledges.

“Compared to the 2021 roadmap, progress has been made in Europe in terms of research & development, policy implementation and delivery of CO2 reductions from fleet renewal, initial uptake of SAF and deployment of ATM solutions. Nevertheless, it is clear that without short-term action from both industry and policymakers, this ambitious decarbonisation pathway will become increasingly more difficult – or even impossible – to follow.”

Updated Destination 2050 roadmap

More News & Features

New studies confirm minor flight re-routing to avoid contrails would have major climate benefits

EU SAF mandates will have to be revised, predicts French oil chief

Swiss advanced SAF technology startups Metafuels and Synhelion reach project milestones

EU states to mobilise 500 million euro support for early-mover eSAF production startups

European Commission announces Sustainable Transport Investment Plan to advance low-and-no-carbon fuels

Cirium analysis challenges assumptions between aviation growth and environmental impact